Investing in precious metals can be a rewarding and secure addition to your financial portfolio. However, the world of precious metals is filled with unique terminology that can be confusing for newcomers. In this article, we’ll introduce you to some of the most common terms you’ll encounter as a new precious metals investor.

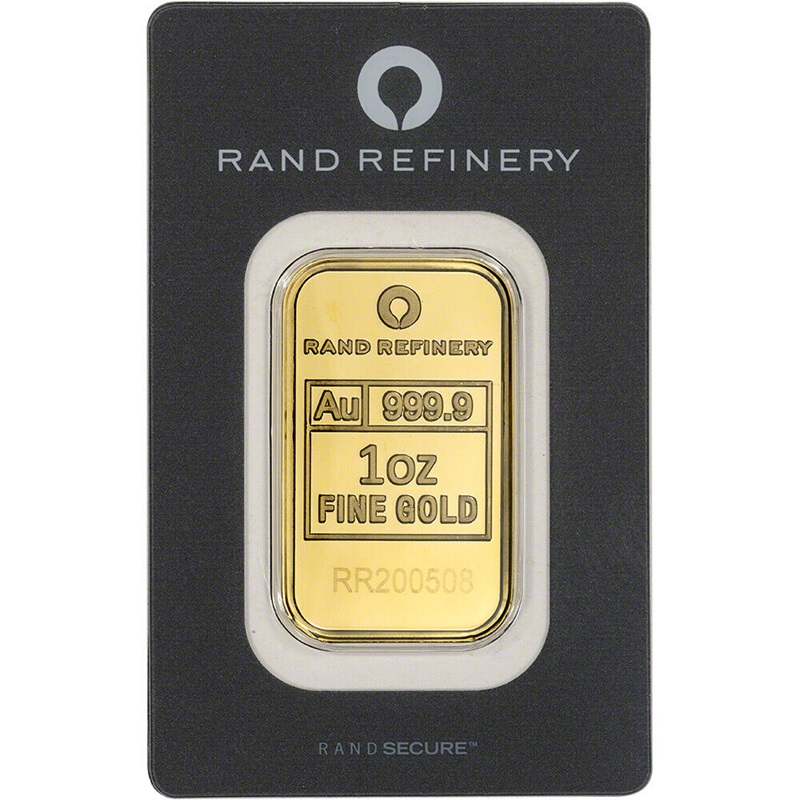

- Assay: An assay is a test to determine the quality and purity of a precious metal product. When a gold or silver product is accompanied by an “assay,” it means that the product has been certified to contain the described amount and purity of the metal.

- Buy/Sell Spreads: The buy/sell spread refers to the difference between a precious metals trader’s buying price and selling price, relative to the spot price of the metal they are trading. This spread represents the profit margin for the trader.

- Condition: The condition of a gold or silver bar, round, or coin refers to its physical state. For example, a “mint condition” coin is one that is in the same state as when it was first minted, with no signs of wear or damage.

- Gold-Silver Ratio: The gold-silver ratio is the amount of silver you can buy with one ounce of gold, based on current spot prices. For example, if the gold-silver ratio is 50, it means that one ounce of gold would buy 50 ounces of silver at current prices.

- Junk Silver: “Junk silver” refers to any silver product that contains less than 90% silver content. These products are often pre-1965 US coins, which contain between 35% and 90% silver.

- Paper Precious Metals: “Paper precious metals” refers to any precious metal investment that doesn’t result in the investor holding the physical metal in hand. Examples include precious metal ETFs, futures contracts, and certificates.

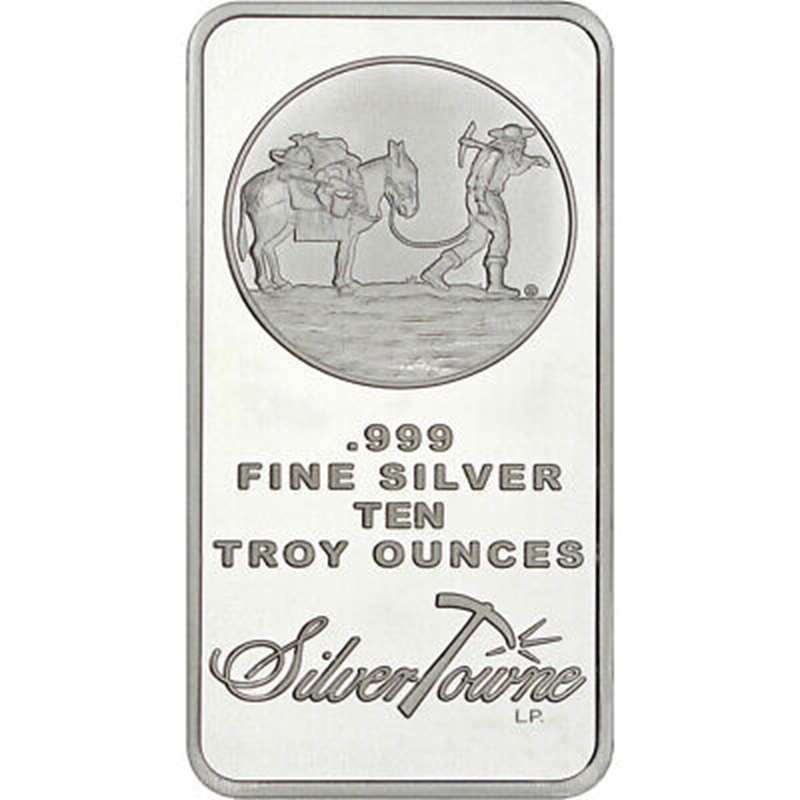

- Purity: The purity of a gold or silver product refers to the percentage of the metal that is pure. For example, a .999 1-ounce silver bar has a purity of 99.9%.

- Year: The year of issue for a gold or silver coin refers to the year the coin was minted. This can be an important factor for collectors, as some years may have lower mintages or other factors that make them more valuable.

Conclusion: By familiarizing yourself with these key terms, you’ll be better equipped to navigate the world of precious metals investing. Remember to do your research, consult with a trusted financial advisor, and always invest within your means. With a solid understanding of the basics, you can confidently begin building your precious metals portfolio.