Silver presents a compelling opportunity with the potential for explosive growth. Silver’s unique combination of industrial utility and safe-haven appeal makes it an undervalued asset poised for a significant price breakout.

Recent market conditions are strikingly similar to those that drove silver to nearly $50 per ounce in 2011 — and investors who recognize the signs now could benefit greatly.

Industrial Demand Surging, Supply Tightening

Silver’s crucial role in solar panels, electric vehicles (EVs), and 5G technology is driving demand to record highs. According to the Silver Institute, industrial use now accounts for nearly half of all silver demand. Silver consumption in the solar sector surged 64% in 2023, and this trend is expected to continue as the global shift toward renewable energy accelerates.

At the same time, silver supply is tightening. Mining output has been slow to recover post-COVID, and silver’s status as a byproduct metal (primarily mined alongside lead, zinc, and copper) limits the ability to rapidly increase production. The result? A growing supply deficit — in 2023 alone, demand outstripped supply by 184 million ounces, creating the most significant deficit in modern history.

This supply-demand imbalance is likely to fuel upward price pressure due to dwindling supplies.

Monetary Policy Creates a Bullish Backdrop for Silver Prices

The Federal Reserve’s aggressive rate hikes have kept silver prices suppresed, but this may be nearing its end. With economic growth slowing and debt levels reaching unsustainable highs, there is fear we may be entering a recession. This may forced the Fed to lower rates. Silver thrives in low-interest-rate environments.

Moreover, silver carries a reputation as a reliable hedge against rising prices and inflation remains stubbornly high. During the inflationary period of the 2008 financial crisis, silver soared from under $10 to nearly $50 as fears gripped investors.

Why Now Is the Time to Buy

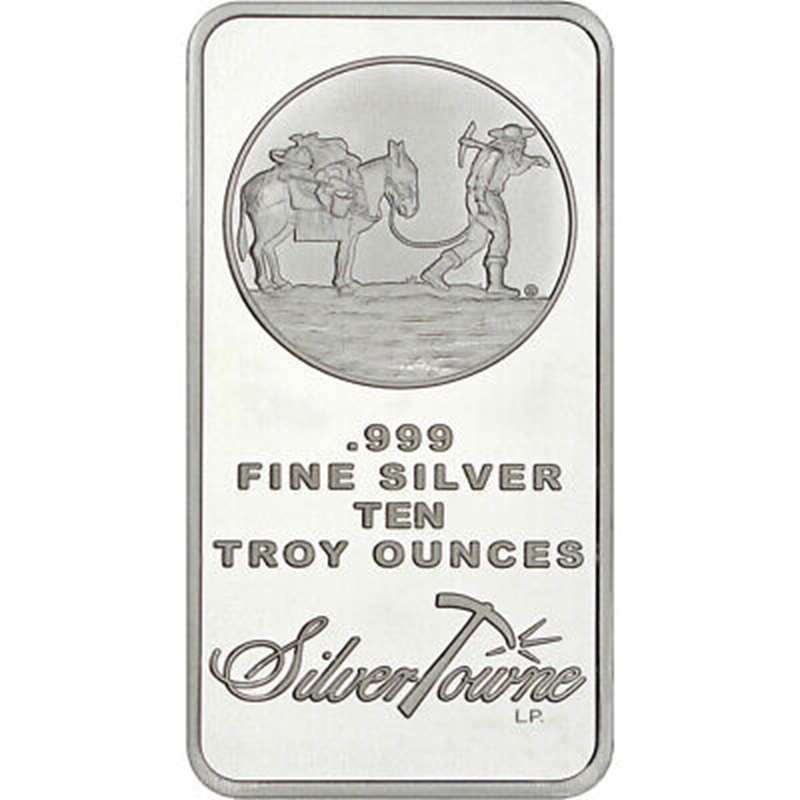

Savvy investors know that timing is everything. The combination of rising industrial demand, persistent supply deficits, and an impending shift in monetary policy has created a window of opportunity. As inflation erodes the value of cash and traditional investments face volatility, silver offers a tangible, historically proven hedge — and one that remains undervalued compared to gold.

In 2011, investors who waited until silver neared $50 missed most of the gains. Today’s market fundamentals suggest silver is once again preparing to surge — and this time, prices could climb even higher. For those seeking to protect wealth, hedge against inflation, or capitalize on a booming industrial metal, silver’s moment is fast approaching.

Don’t wait until prices spike — buy silver now while it’s still undervalued.