A Precious Metals IRA is a type of individual retirement account that allows investors to hold physical precious metals, such as gold, silver, platinum, and palladium, in a tax-advantaged retirement account. Unlike traditional IRAs, which typically hold paper assets like stocks and bonds, Precious Metals IRAs provide a way to diversify and hedge against inflation and economic uncertainties by holding tangible assets.

Precious Metals IRAs must be managed by an IRS-approved custodian or trustee. The custodian is responsible for administering the account, purchasing the metals on your behalf, and ensuring they are stored in an approved depository.

The physical precious metals in a Precious Metals IRA must be stored in an IRS-approved depository. These depositories are secure, third-party facilities that specialize in the storage of precious metals. Home storage of IRA metals is not permitted.

Requirements for Individuals Who Want a Precious Metals IRA

- Eligible Metals: Only certain types of precious metals are allowed. The metals must meet specific fineness standards:

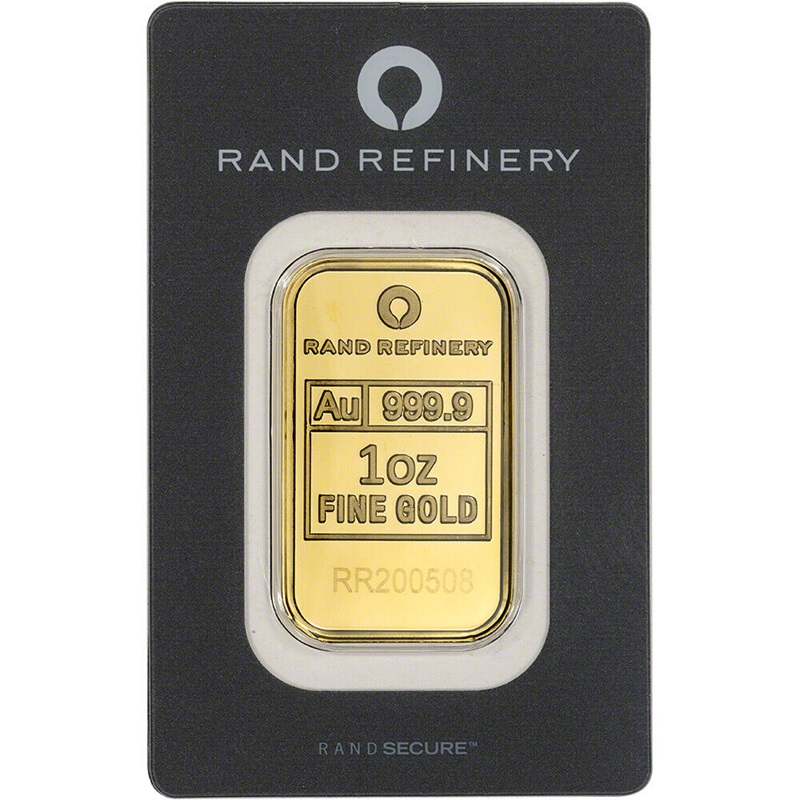

- Gold: Minimum fineness of .995 (e.g., American Gold Eagle coins, Canadian Gold Maple Leaf coins)

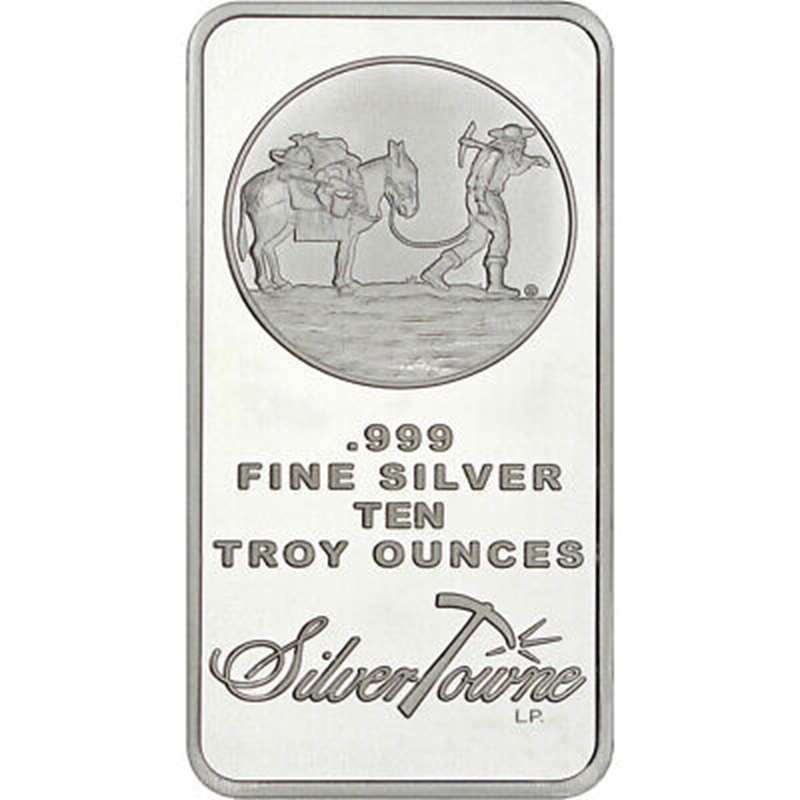

- Silver: Minimum fineness of .999 (e.g., American Silver Eagle coins)

- Platinum: Minimum fineness of .9995

- Palladium: Minimum fineness of .9995

- Approved Custodian: The IRA must be managed by an IRS-approved custodian or trustee who handles the purchasing, storing, and administration of the precious metals.

- Storage Requirements: The precious metals must be stored in an approved depository. These depositories are secure, third-party facilities that specialize in storing precious metals.

- Contribution Limits: Contributions to a Precious Metals IRA are subject to the same annual limits as traditional IRAs. For 2024, the limit is $6,500, or $7,500 if you are 50 or older.

- Required Minimum Distributions (RMDs): Starting at age 72, account holders must begin taking RMDs from their IRA accounts, including Precious Metals IRAs.

How Does a Precious Metals IRA Provide Income When I Retire?

- Distributions: When you reach retirement age, you can start taking distributions from your Precious Metals IRA. These distributions can be in the form of the physical precious metals or cash equivalent, depending on your preference and the policies of your IRA custodian.

- Selling Metals: If you choose to sell the metals, the custodian will liquidate them and provide you with the proceeds. This cash can then be used as retirement income.

- In-Kind Distributions: You can opt to receive the physical metals themselves as distributions. The value of the metals at the time of the distribution will be reported to the IRS, and you will need to pay taxes based on that value.

Pros and Cons of Precious Metals IRAs

Pros

- Diversification: Precious metals offer diversification from traditional paper assets, reducing overall portfolio risk.

- Hedge Against Inflation: Precious metals, particularly gold, are historically considered a hedge against inflation and currency devaluation.

- Tangible Assets: Holding physical metals provides a sense of security and ownership that paper assets cannot.

- Potential for Appreciation: If the value of precious metals rises, so does the value of your IRA holdings.

Cons

- Storage and Insurance Fees: There are additional costs associated with storing and insuring physical metals in an approved depository.

- Limited Growth Potential: Unlike stocks and bonds, precious metals do not generate interest or dividends, which can limit growth potential.

- Liquidity: Selling physical metals can be less straightforward than selling paper assets, potentially leading to delays in accessing funds.

- Higher Costs: Precious Metals IRAs often come with higher fees than traditional IRAs, including transaction fees, custodial fees, and storage fees.

How to Convert Existing Precious Metals Assets into a Precious Metals IRA

- Select an Approved Custodian: Choose an IRS-approved custodian who specializes in Precious Metals IRAs. The custodian will manage the account and ensure compliance with IRS regulations.

- Open a Precious Metals IRA Account: Complete the necessary paperwork to open a new IRA account with the chosen custodian.

- Fund the IRA:

- Transfer/Rollover: If you have an existing IRA, 401(k), or another retirement account, you can transfer or roll over funds into the new Precious Metals IRA.

- Direct Purchase: If you already own precious metals that meet IRS standards, you may be able to transfer them directly into the IRA. The custodian will arrange for the metals to be shipped to an approved depository.

- Purchase Metals: If you are funding the IRA with cash, the custodian will assist in purchasing approved precious metals on your behalf.

- Storage: The custodian will arrange for the storage of the precious metals in an IRS-approved depository.

Conclusion

A Precious Metals IRA offers a unique way to diversify your retirement portfolio with tangible assets that can provide a hedge against inflation and economic uncertainty. While there are additional costs and considerations, the potential benefits of holding physical precious metals in a tax-advantaged account can be substantial for the right investor. By understanding the requirements, benefits, and drawbacks, you can make an informed decision about whether a Precious Metals IRA is suitable for your retirement strategy.