Silver rounds are popular among investors for their purity and collectible appeal. This guide aims to provide beginners with a comprehensive understanding of silver round prices, how they are determined, and factors influencing their value.

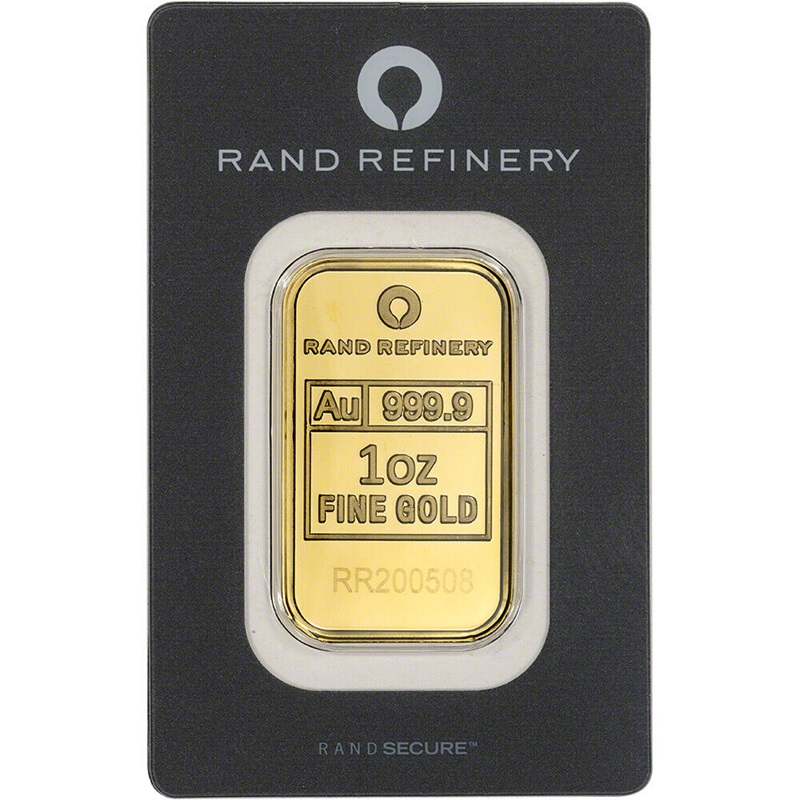

Investing in precious metals can be a lucrative venture, especially for those looking to diversify their portfolios beyond traditional stocks and bonds. Silver, in particular, is highly valued for its industrial applications and as a store of value.

What are Silver Rounds?

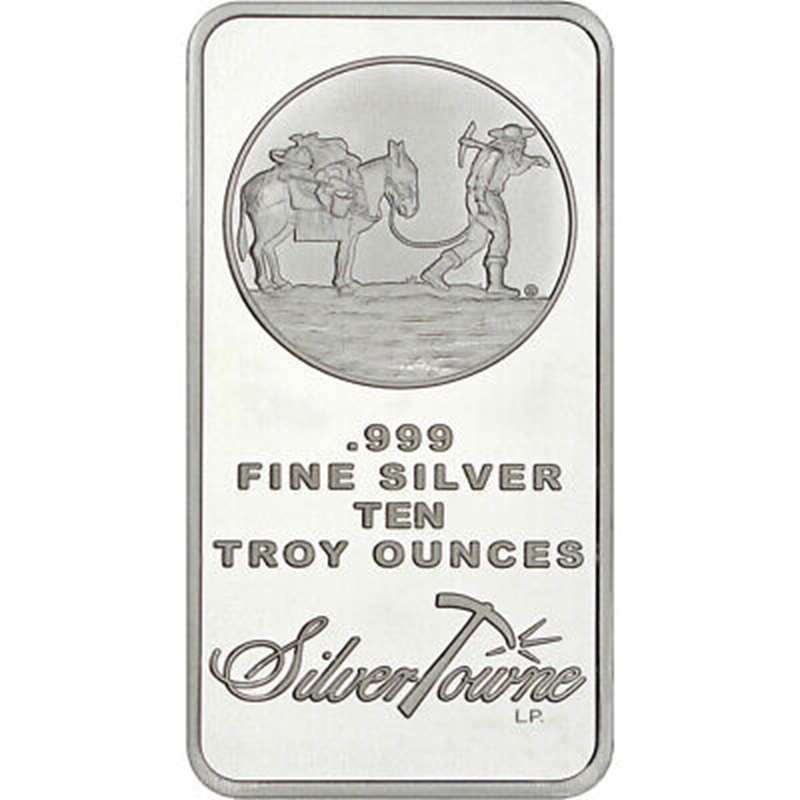

Silver rounds are bullion pieces minted from silver, typically with a purity of .999 fine silver or higher. Unlike sovereign coins issued by governments, silver rounds are produced by private mints and are not considered legal tender. They come in various weights, ranging from 1 ounce to 10 ounces or more, and often feature unique designs that appeal to collectors.

Silver rounds are valued primarily for their silver content and may carry premiums based on factors such as rarity, design intricacy, and market demand.

Factors Influencing Silver Round Prices

- Spot Price of Silver:

- The spot silver price is the current market price at which the metal is traded globally. It is influenced by supply and demand dynamics, economic conditions, geopolitical events, and investor sentiment. The spot price forms the base value of silver rounds.

- Premium Over Spot:

- Silver rounds are sold at a premium over the spot price. This premium covers production costs, minting fees, and the profit margin for the mint or dealer. The premium can vary widely depending on the design and popularity of the silver round.

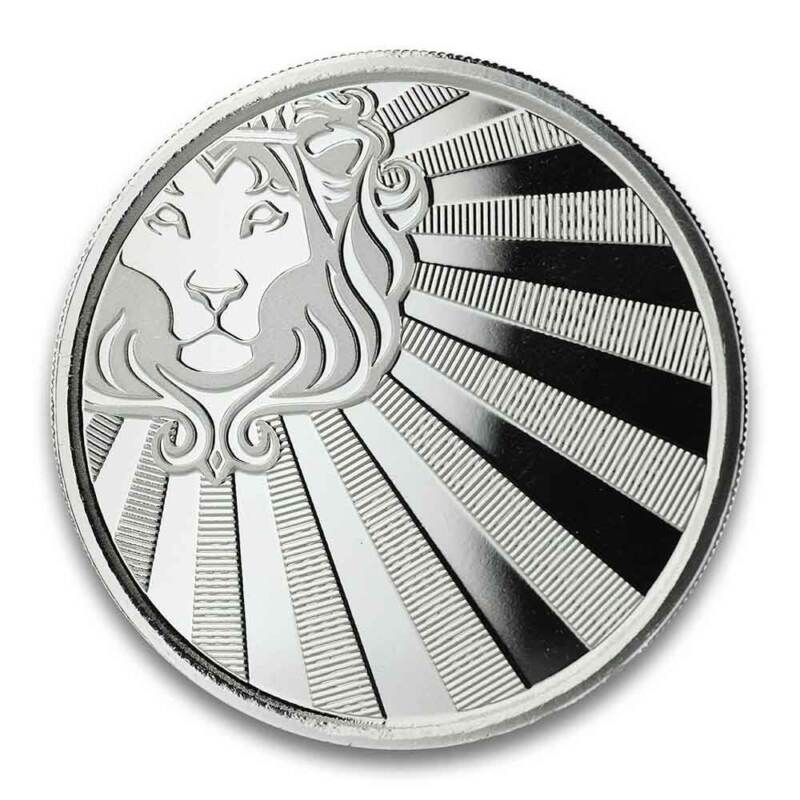

- Design and Collectibility:

- Silver rounds with intricate designs, limited mintages, or historical significance often command higher premiums. Collectors may be willing to pay more for rounds featuring famous landmarks, historical figures, or commemorative themes.

- Condition and Rarity:

- The condition and rarity of silver rounds can significantly impact their value. Rounds in pristine condition or those with a limited mintage are generally more sought after and may fetch higher prices in the secondary market.

How Silver Round Prices Are Determined

- Wholesale Market:

- Mints and dealers set initial wholesale prices based on the current spot price of silver, production costs, and desired profit margins.

- Retail Market:

- Retail prices include the wholesale price of the silver round plus additional premiums determined by the dealer. These premiums cover handling, storage, and transaction costs associated with selling silver rounds to individual investors.

Investing in Silver Rounds

Tips for Investors:

- Research and Compare:

- Research different types of silver rounds available in the market, compare prices from reputable dealers, and understand the premiums associated with each option. Websites like APMEX, Kitco, and SD Bullion offer extensive selections and price comparisons.

- Buy from Reputable Dealers:

- Purchase silver rounds from established dealers with a track record of reliability and transparency. Avoid deals that seem too good to be true, as they may involve counterfeit or overpriced products.

- Consider Storage:

- Decide whether to store silver rounds at home or use secure storage facilities offered by dealers or third-party custodians. Proper storage helps preserve the value and condition of your investment over time.

Conclusion

Understanding silver round prices is essential for anyone interested in investing in precious metals. By knowing how prices are determined, the factors influencing them, and the considerations for purchasing silver rounds, investors can make informed decisions to build a diversified portfolio. Whether for financial security or collectible enjoyment, silver rounds offer a tangible asset with enduring value in today’s uncertain economic landscape.