Bullion investing involves buying precious metals like gold, silver, platinum, and palladium in the form of bars or coins. This guide will cover the basics of bullion investing, including what it is, how it works, and the potential benefits and risks.

What is Bullion Investing?

Bullion refers to precious metals like gold, silver, platinum, and palladium that are in the form of bars or coins. These metals are valued by their weight and purity. Bullion investing involves buying these metals with the intention of holding them as a store of value or as a hedge against inflation.

Types of Bullion

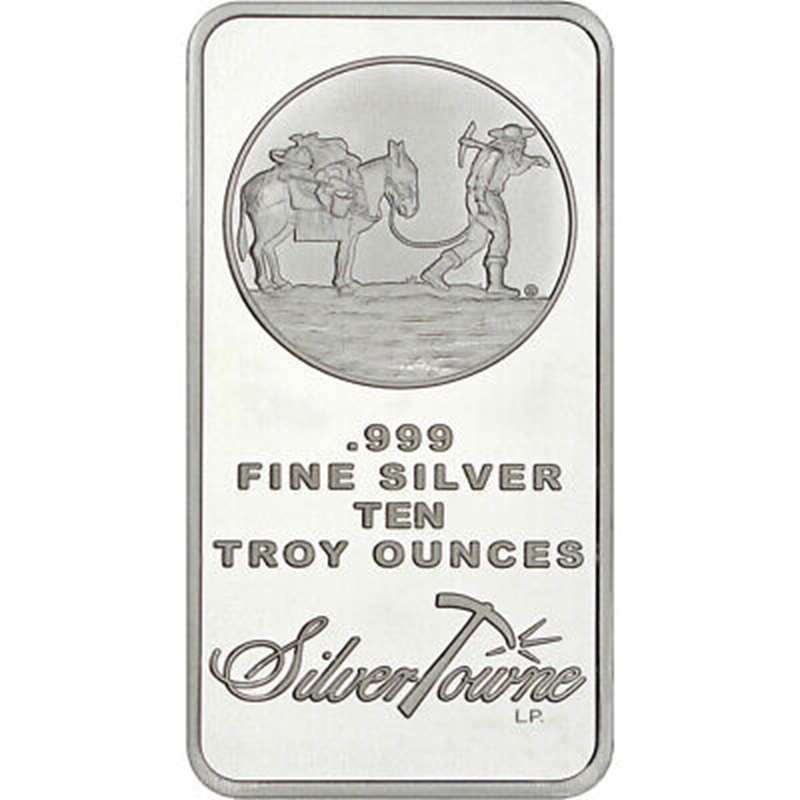

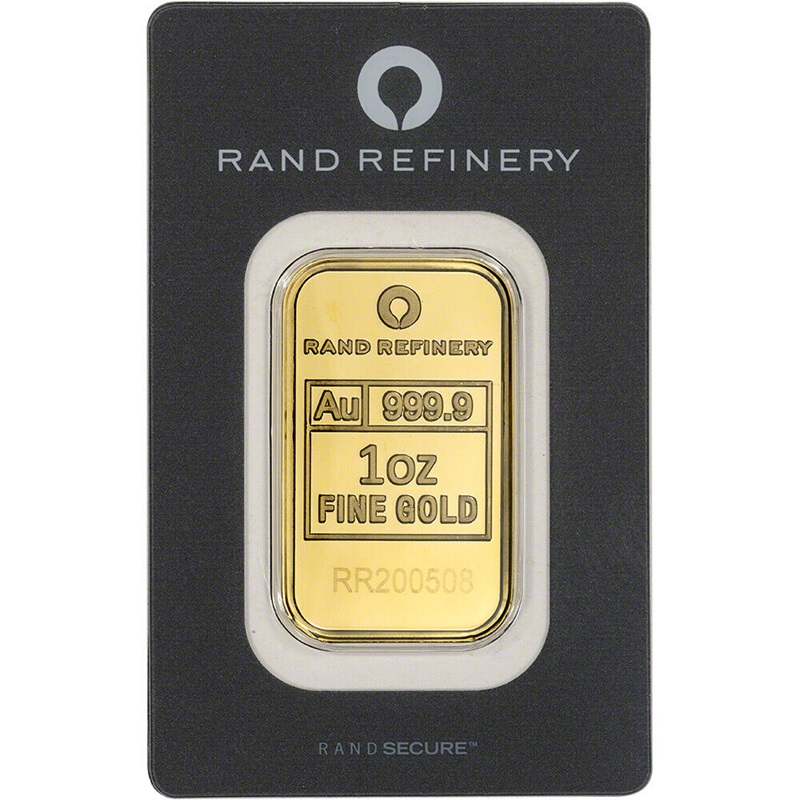

There are three main types of bullion: rounds, bars and coins. Bullion bars are available in various sizes and weights, from a few grams to several kilograms. Bullion coins are minted by government mints and have a face value, but their value is primarily based on the metal content.

Bullion refers to gold, silver and other precious metals that is officially assayed as being at least 99.5% and 99.9% pure and is in the form of coins, bars or ingots. It is used as a store of value, and the purity of gold bullion is often assessed through the centuries-old technique of fire assay in conjunction with modern spectroscopic instrumentation to accurately determine its quality.

Bullion is traded in the bullion market, which is primarily an OTC market open 24 hours a day. Investors can also buy a bullion futures contract, which is an agreement to buy or sell an asset or commodity at a preset price with the contract settling at a specific date in the future. With gold and silver futures contracts, the seller is committing to deliver the gold to the buyer at the contract expiry date.

Advantages of Bullion Investing

- Hedge against inflation: Precious metals like gold and silver have historically held their value during times of inflation.

- Portfolio diversification: Bullion can help diversify a portfolio, as its price movements are often uncorrelated with those of stocks and bonds.

- Tangible asset: Bullion is a physical asset that you can hold in your hand, providing a sense of security and control.

Risks of Bullion Investing

Price volatility: The price of precious metals can be volatile, and investors should be prepared for price fluctuations.

Storage and insurance: Bullion requires secure storage and may need to be insured, which can add to the cost of investing.

Liquidity: While bullion is a liquid asset, it may not be as easy to sell as stocks or bonds.

How to Invest in Bullion

- Buy physical bullion: Purchase bars or coins from a reputable dealer.

- Invest in a bullion-backed ETF: Exchange-traded funds (ETFs) that hold physical bullion provide exposure to the metal without the need for storage or insurance.

- Invest in mining stocks: Another option is to invest in the stocks of companies that mine precious metals.

Tax Implications

- Capital gains tax: When you sell bullion at a profit, you may be subject to capital gains tax.

- Long-term vs. short-term: The tax rate depends on whether you held the bullion for more than a year (long-term) or less than a year (short-term).

Conclusion

Bullion investing can be a valuable addition to a diversified investment portfolio. It provides a hedge against inflation and offers the potential for long-term growth. However, it’s essential to understand the risks and costs associated with investing in precious metals before making a decision.