Whether you’re a seasoned “metal maniac” or just starting out in the world of precious metals, silver bars offer a blend of affordability, liquidity, and tangible value that can enhance your investment strategy.

Here, we’ll provide insights into why silver bars are a solid investment, how to get started, and what to consider when you invest.

Why Invest in Silver Bars?

- Diversification

Silver bars provide a hedge against market volatility and provides diversification beyond traditional stocks and bonds. Unlike stocks and bonds, precious metals often maintain or increase their value during economic downturns, making them a valuable addition to any investment portfolio. - Hedge Against Inflation

Silver, like gold, is known for its ability to preserve purchasing power over time. When inflation erodes the value of fiat currency, silver tends to appreciate, making it a reliable store of value. - Tangible Asset

Owning physical silver bars gives you a sense of security. Unlike digital assets or paper investments, you can hold silver in your hand, store it securely, and use it in case of emergencies.

Silver bars are a quintessential tangible asset due to their physicality, intrinsic value, and durability. They provide direct ownership without any third-party custodial issues and act as a hedge against economic instability.

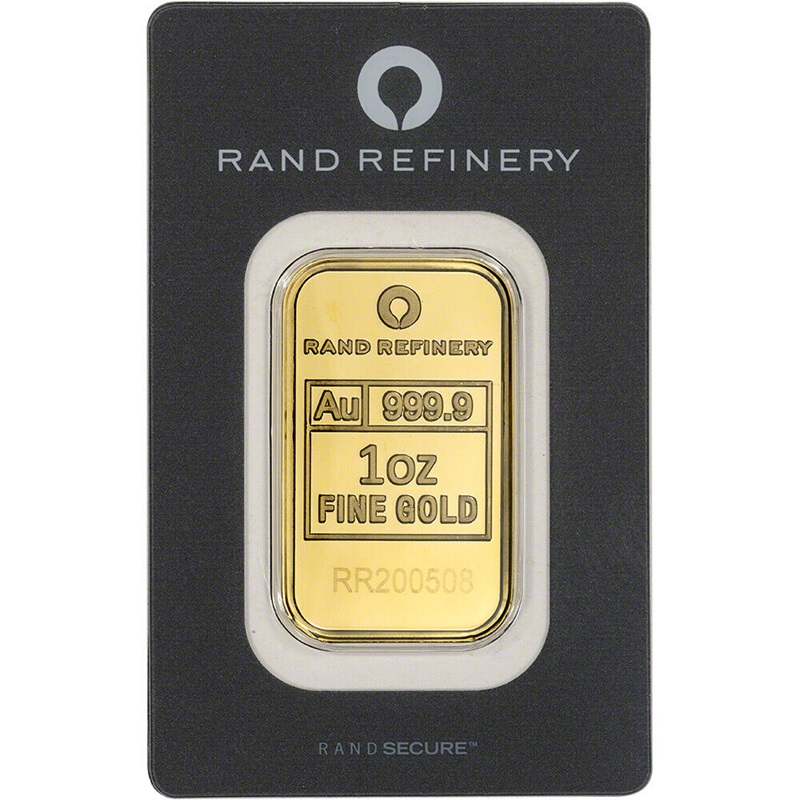

Comparable tangible assets include gold bars, real estate, collectible coins, precious stones, artwork, fine jewelry, antiques, and industrial metals. Each of these assets shares the characteristic of being a physical item with inherent value, making them valuable additions to a diversified investment portfolio. - Affordability

Compared to gold, silver is much more affordable, allowing investors to start building their holdings without needing a large initial investment.

The spot price of silver is significantly lower than that of gold. As of recent market data, the price of an ounce of gold is typically several times higher than an ounce of silver. For example, if gold is priced at $1,800 per ounce, silver might be around $25 per ounce. This accessibility is particularly appealing to the budding metal maniac.

Types of Silver Bars

Silver bars come in various sizes, each catering to different investment strategies:

- 1 oz Silver Bars

These are perfect for beginners and those looking to make small, incremental investments.

They are small and extremely portable and easy to store. In the bullion markets, 1 oz silver bars are highly liquid, are easily sold or traded for cash.

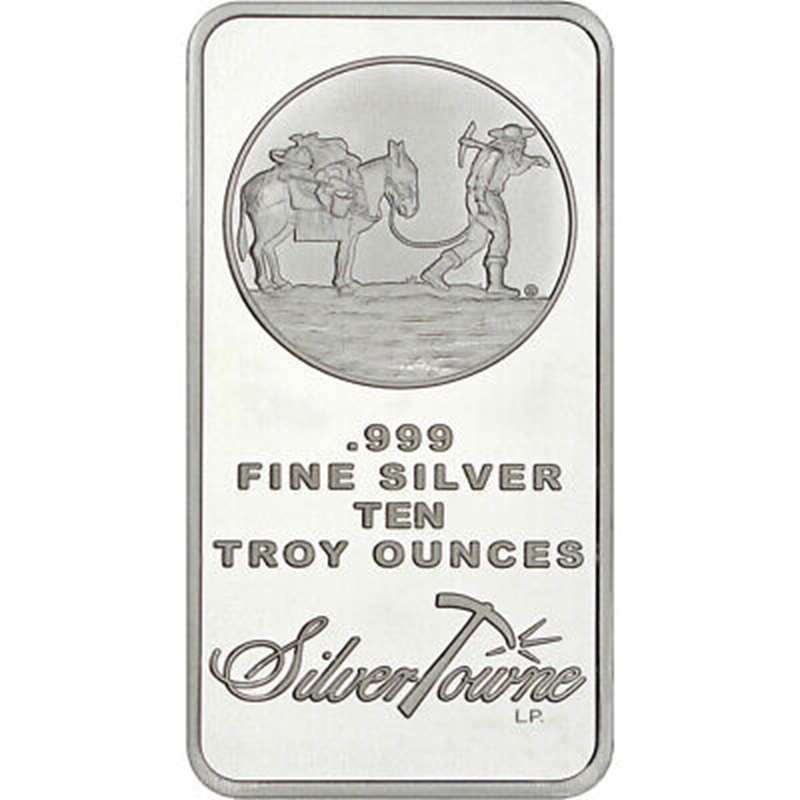

They offer a lower initial cost, making them an accessible choice for most investors. Smaller bars typically hav higher premiums over spot price due to smaller size and minting costs. - 10 oz Silver Bars

Popular among both new and experienced investors, these bars strike a balance between affordability and substantial value.

10 oz silver bars offer outstanding liquidity in secondary markets, though finding the right buyer may take more effort.

When investing in silver bars, larger sizes offer a more cost-effective per ounce compared to 1 oz bars.

Premiums over spot price per ounce for 10 oz silver bars are lower compared to 1 oz bars, making them a popular choice for investors. - 100 oz Silver Bars

Ideal for serious investors wanting to make a significant investment in silver.

100 oz silver bars are bulkier and heavier, requiring more storage space.

While all silver bars are highly liquid, finding the right buyer for a 100 oz silver bar will require more research, effort and possibly an appraisal when looking to sell.

Buying 100 oz silver bars offers the most cost-effective per ounce. Dealer premiums are significantly lower over spot price, offering the best value per ounce for large investments.

How to Buy Silver Bars

- Choose a Reputable Dealer

Ensure you buy from reputable sources to guarantee the authenticity and quality of your silver bars. Trusted dealers include APMEX, JM Bullion, and local coin shops with strong reputations. - Check the Spot Price

Silver prices fluctuate daily, so it’s important to check the current spot price before purchasing. Silver bars are typically sold at a small premium over the spot price. - Consider Storage Options

Decide where to store your silver bars. Options include home safes, safety deposit boxes, or secure storage facilities provided by the dealer.

Pros and Cons of Investing in Silver Bars

Pros:

- Liquidity: Silver bars are easy to buy and sell, making them a highly liquid asset.

- Affordability: They offer a cost-effective way to invest in precious metals.

- Tangible Value: As a physical asset, silver bars provide security that digital or paper assets cannot match.

Cons:

- Storage Costs: Secure storage can add to the cost of your investment.

- Market Volatility: Silver prices can be volatile, so it’s important to stay informed about market trends.

Conclusion

Investing in silver bars can be a rewarding endeavor for any metal maniac looking to diversify their investment portfolio. With their affordability, liquidity, and tangible value, silver bars are a smart choice for both novice and experienced investors. Whether you’re buying a few 1 oz bars or investing in hefty 100 oz bars, silver offers a reliable hedge against economic uncertainty and inflation.

So, if you’re ready to embrace your inner metal maniac and start stacking silver bars, now is the perfect time to jump into the market. Happy investing!