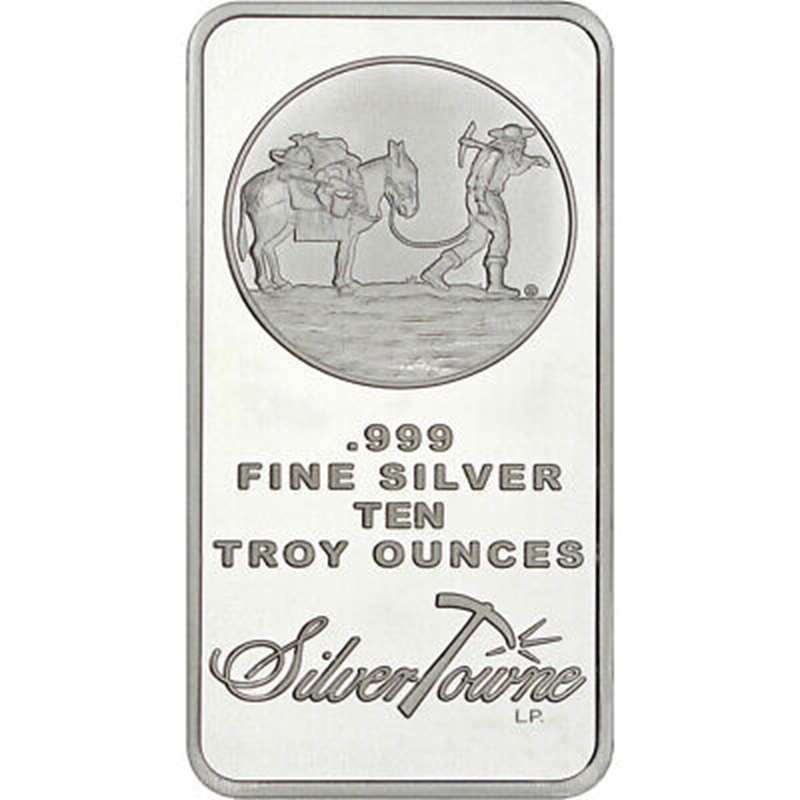

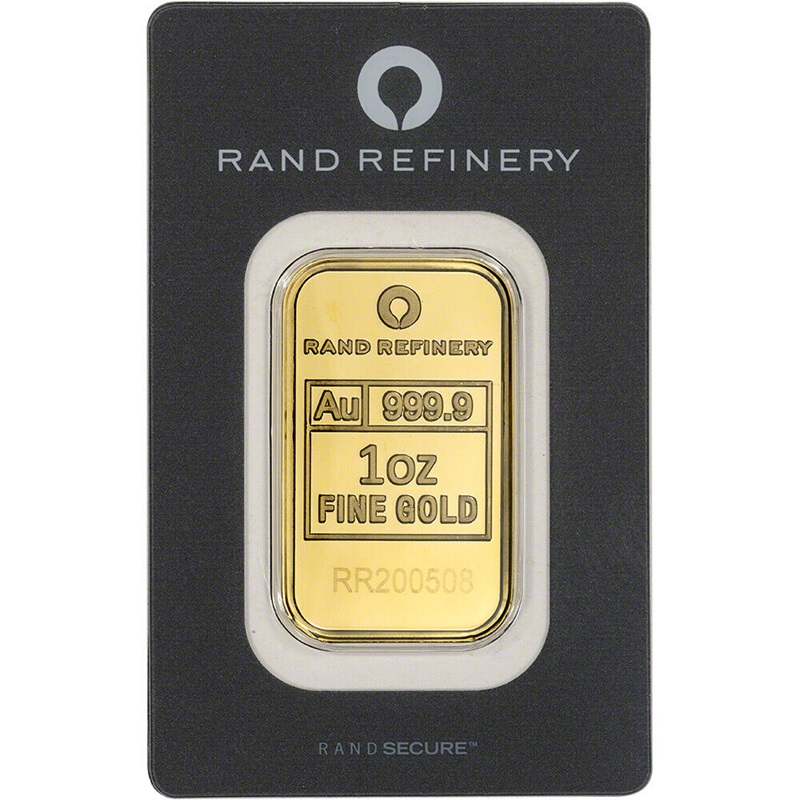

Gold has long been considered a symbol of wealth and value. Whether for investment, jewelry, or as a hedge against economic instability, gold bars are a popular choice. The price of gold bars, however, is influenced by several factors, ranging from global economics to market demand. This article explores these factors and provides insights into what makes the price of gold bars fluctuate.

The Role of Supply and Demand

The fundamental economic principle of supply and demand significantly impacts gold bar prices:

- Demand Fluctuations: When demand for gold bars increases, prices tend to rise. Conversely, when demand decreases, prices fall. This demand is influenced by various factors, including economic stability, investment trends, and cultural significance in different regions.

- Stable Supply: The supply of gold is relatively stable because gold mining is a complex and expensive process. Thus, short-term changes in supply are minimal. However, recycled gold from jewelry, electronics, and other items adds to the supply, influencing prices.

- Central Banks and Governments: Central banks and governments hold substantial gold reserves. Their decisions to buy or sell these reserves can significantly impact gold bar prices. For example, large-scale purchases can drive up prices, while significant sales can depress them.

Impact of Economic Indicators

Economic indicators are crucial in determining gold bar prices. Key indicators include inflation, interest rates, and currency values:

- Inflation: Rising inflation decreases the value of paper currency, leading people to invest in gold as a store of value. This increased demand typically raises gold bar prices.

- Interest Rates: Higher interest rates make non-yielding assets like gold less attractive. Conversely, when interest rates are low, gold becomes more appealing, driving up its price.

- Currency Values: The value of the US dollar, in particular, is influential. Gold is typically priced in dollars, so when the dollar weakens, gold becomes cheaper for foreign buyers, boosting demand and prices.

Geopolitical Events and Stability

Geopolitical events and regional stability can significantly impact gold bar prices. Wars, political unrest, and economic crises often drive people to invest in gold as a safe haven, increasing demand and prices. Historical examples include:

- 2008 Financial Crisis: Gold prices soared as investors sought security in precious metals.

- Middle East Tensions: Political and military tensions in regions like the Middle East can lead to market uncertainty, prompting a rush to gold and higher prices.

Influence of Market Speculation

Market speculation can create short-term price fluctuations. Traders and investors buy and sell gold based on future price predictions:

- Anticipated Economic Reports: If investors anticipate negative economic growth, they might buy gold expecting a price rise, driving up prices preemptively.

- Speculative Selling: Conversely, expected positive economic news can lead to speculative selling, causing prices to drop.

Gold Production Costs

The cost of producing gold also influences its price:

- Mining Expenses: Mining operations are expensive, requiring significant investment in equipment, labor, and energy. Higher production costs can reduce supply and drive up prices.

- Geopolitical Stability: Political instability in major gold-producing countries can disrupt mining operations, reducing supply and increasing prices.

Impact of Central Banks and Government Policies

Central banks and government policies profoundly affect gold bar prices:

- Gold Reserves Management: Central banks influence prices by buying or selling gold reserves.

- Government Policies: Policies related to taxation, mining regulations, and trade can affect prices. For example, higher taxes on gold imports can increase costs for buyers, leading to higher prices.

Conclusion

Understanding how gold bar prices are determined involves looking at a complex interplay of factors including supply and demand, economic indicators, geopolitical events, market speculation, production costs, and central bank policies. By monitoring these factors, investors and buyers can make more informed decisions about purchasing gold bars.