ETF investing in gold, silver, and other bullion metals has gained significant traction in recent years. Exchange-traded funds (ETFs) offer investors an accessible and cost-effective way to gain exposure to precious metals without the need to physically own and store the assets.

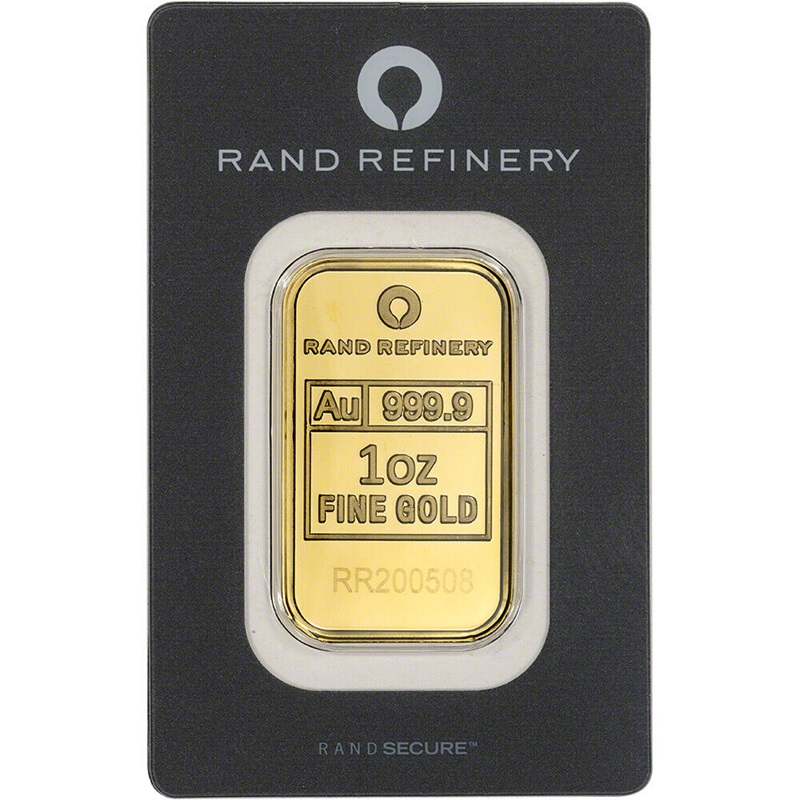

- Gold ETFs are among the most popular precious metals ETFs. These funds typically hold physical gold bullion or track the price of gold using futures contracts. Some of the top gold ETFs include SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and Physical Gold Shares (SGOL). These ETFs provide investors with a convenient way to invest in gold and benefit from its potential as a hedge against inflation and economic uncertainty.

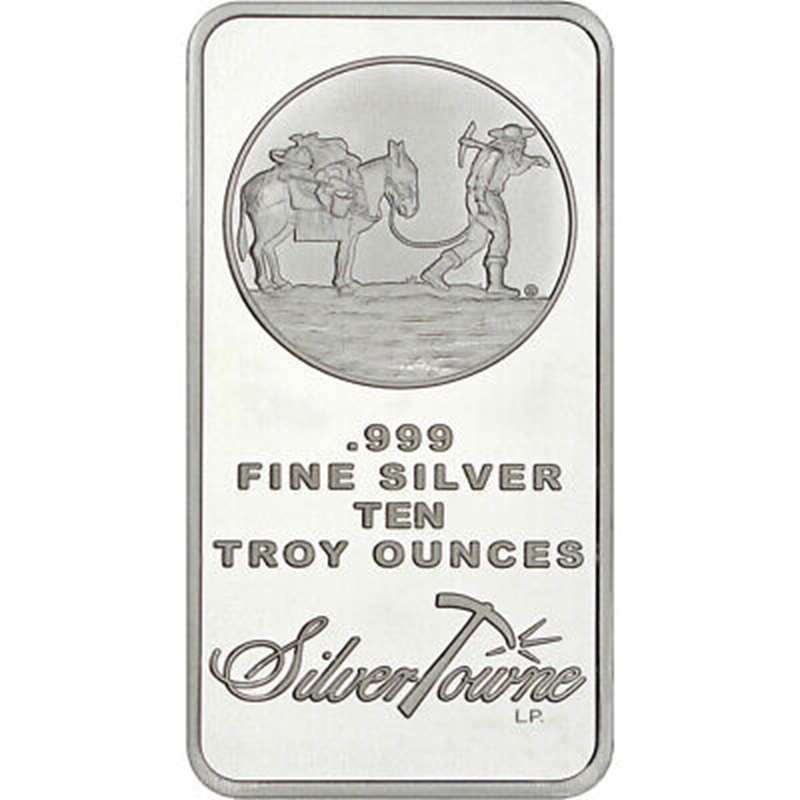

- Silver ETFs offer investors exposure to the price movements of silver. The iShares Silver Trust (SLV) is one of the most well-known silver ETFs. It holds physical silver bars stored in bank vaults. Other silver ETFs, such as the ETFMG Prime Junior Silver Miners Fund (SILJ), focus on silver mining stocks.

- Platinum ETFs typically hold physical platinum in the form of bars or coins, and their price is designed to track the spot price of platinum. Examples of platinum ETFs include the Physical Platinum Shares ETF (PPLT) and the GraniteShares Platinum Trust (PLTM).

- Palladium ETFs track the price of palladium. These ETFs may hold physical palladium or invest in palladium futures contracts. An example of a palladium ETF is the Physical Palladium Shares ETF (PALL).

- Rhodium ETFs can be volatile due to the limited supply and high demand for rhodium, particularly in the automotive industry. Also, geopolitical events in major rhodium-producing countries like South Africa and Russia can have a great impact on supply, leading to shortages and huge price swings. One of the most well-known rhodium ETFs is the Xtrackers Physical Rhodium ETC (XRH0), which holds physical rhodium bars in secure vaults.

- Uranium ETFs focus on companies involved in the uranium mining industry, including exploration, mining, and equipment manufacturing. Some examples of uranium ETFs include the Global X Uranium ETF (URA) and the Sprott Uranium Miners ETF (URNM).